Table of Content

The cash bonus is available on new refinances of $250,000 or more and drawdown must occur from 7 September 2020 until the time the offer is withdrawn. Purchasing an investment property is exciting, no matter if it is your first or your fifth. Our team of branch lending experts, mobile and phone bankers are here to guide and support you through the process. A number of other loans in the same product category with 80% LVR, and also ones paying interest-only, were cut by up to 45 basis points. NAB also cut interest rates on the same product line fixed for four and five years by 20 basis points.

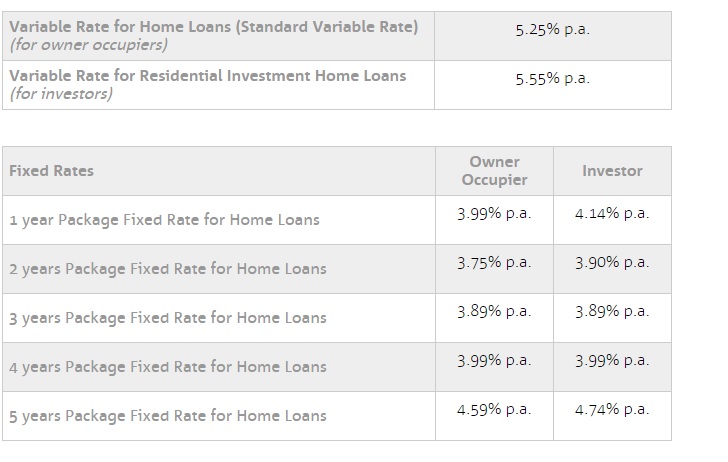

Rates and information current as at 19 December 2022 and are subject to change at any time. NAB Tailored Home Loan fees, charges, terms and conditions are available on request. Choice Package discounts and benefits only apply whilst your loan is part of a NAB Choice Package.

Easy access to your money

Chen and Grace initially thought securing a large investment loan as a self-employed couple would be a daunting task. In the end, they were very grateful for Robert’s help in setting them on their journey to owning an investment property. They wanted to purchase an investment property but were troubled by the fact that it was difficult for them to find a lender willing to provide more than $1.5 million.

This includes package home loans with lots of extra features and simpler loans with just the basics. Take advantage of our simple, low rate home loan with no ongoing fees. Lock in a great rate and know that your minimum repayments won’t change during the fixed term.

NAB Choice Package – Principal and Interest – Residential Investment

Make extra repayments up to $20,000 within the fixed rate term without paying any fees. Enjoy a low rate, no application or ongoing fees with our basic, variable rate home loan. Providing or obtaining an estimated insurance quote through us does not guarantee you can get the insurance. Acceptance by insurance companies is based on things like occupation, health and lifestyle. By providing you with the ability to apply for a credit card or loan, we are not guaranteeing that your application will be approved. Your application for credit products is subject to the Provider's terms and conditions as well as their application and lending criteria.

The NAB Portfolio Facility is a line of credit that allows you to access the equity in your home. You need to decide whether you need features like a 100% offset account, the ability to make extra repayments and the option to split your rate. Get discounts and benefits with your fixed rate home loan through the NAB Choice Package. For owner occupiers with a NAB Choice Package home loan making principal and interest repayments.

NAB mortgage features

NAB’s fixed rate home loan has similar extra features to the variable rate loan, when bundled with a NAB Choice Package. NAB continues to offer highly competitive fixed rate terms, and borrowers seeking certainty about their repayments may want to consider fixing part or all of their home loan. A fixed rate loan offers total certainty about your rate, for the fixed period. But if your lender starts lowering rates you won't benefit either. Refinancing a fixed rate loan means breaking the loan, because you've agreed to a specific rate.

Depending on what type of home loan you have, you may make principal and interest repayments, or interest-only repayments. NAB Premier Banking Our specialist bankers can provide you with a personalised, premier service tailored to your situation. Make your move a little easier with a $2,000 cash bonus when you refinance your existing home loan to NAB. Make your move a little easier with a $2000 cash bonus when you refinance your existing home loan to NAB. This slight hike on home loans recently is not unique - ME Bank raised ratesby up to 30 basis points at the start of May, a day before itsredraw controversy broke.

Home Loan ExpertsOur expert broker Robert Mo had the pleasure of working with the couple. Firstly, Robert had to deal swiftly with the discrepancies in the declared expenses so upon receiving permission from the couple, Robert amended the mistakes in their declared expenses. After that, it was all about finding the right lender who was willing to let them borrow more than $1.5 million. The total loan amount they were after stood at $2.2 million. Due to Chen and Grace’s excellent income stream, loan security, and strong asset backing, the chances were high to get their loan approved.

Alternatively, if you have or are intending to borrow more than $850,000, learn how you might benefit from becoming a premier customer. Here’s a snapshot of our different home loans to help you make a decision. This section contains Important Information relevant to the page you are viewing, but you can't see it because you have JavaScript disabled on your browser.

The NAB Tailored Home Loan - Fixed Interest Rate helps you work out your budget as it keeps repayments the same over the fixed period and includes many great features to suit everyone. Marc Terrano is a lead publisher and growth marketer at Finder. He has previously worked at Finder as a publisher for frequent flyer points and home loans, and as a writer, podcast host and content marketer. Marc has a Bachelor of Communications from the University of Technology Sydney. He’s passionate about creating honest and simple reviews and comparisons to help everyone get value for money.

Chen is a general practitioner and his wife, Grace, is the managing director at an online-tutoring firm. Both have a healthy income stream and credit history, and a strong list of assets. Our award-winning mortgage brokers will find you the right home loan for your needs. However, Dr Wilson also said overall owner occupier growth was still at "record-high levels", but also said recent government stimulus announcements will have minimal impact.

Curiously, NAB made cuts by up to 60 basis points on its 'In Arrears' products, which despite what the name might suggest, aren't for people falling behind on their mortgages. The lowest deposit you need to apply for a Defense Home Loan is 5%. However, NAB may require you additional deposit depending on their assessment of your application including all the other benefits that you are entitled to. These special offer rates represent up to a 182 basis point discount off the standard rate, and are available to new borrowers only, including refinancing. The two home loans in question are for NAB's 'Base Variable Rate' offering, paying both principal and interest (P&I) and interest-only . NAB currently has the lowest Standard Variable Rate of the major banks.

The credit provider’s final decision is made at their discretion, subject to decisioning criteria. Additional flexibility, features and discounts come when a variable rate loan is bundled with a NAB Choice Package. Conditions, fees and eligibility criteria apply to NAB’s products. Customers who want to know more about these changes are encouraged to contact their banker about what works best for them.

There is a choice of the three standard repayment frequencies on this loan; weekly, fortnightly or monthly repayments. “We acknowledge our housing investors paying interest-only have some of the highest rates, which is why we have decided to cut their rate by 30-basis points. Some of the products and services listed on our website are from partners who compensate us.

No comments:

Post a Comment